Summer Budget

After last month’s budget, we at ad+ have been reviewing the Chancellor’s statement and the Budget documents to interpret the impact on our clients.

The good news is the further increase in the personal allowance and higher rate threshold, which has benefits for all. For business owners, the increase in Employment Allowances adds a further saving of £1,000 and the changes in Corporation Tax Rates will reduce the tax charge to 18% in the coming years.

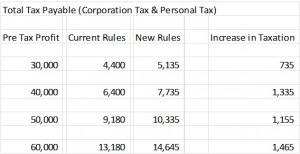

The big change announced which impacts on clients is the change to the taxation of dividends which will impact upon clients who operate their business via a limited company, with their remuneration being taken via Low Salary & Dividends. The Chancellor has announced changes to the way dividends are taxed, which will alter the level of tax paid. A summary table of the tax changes is included below, highlighting the total tax payable at varying levels of profit:

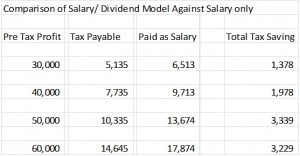

The table highlights that the Chancellor has brought in a tax rise; however, there are still many benefits and savings to operating the low salary/ dividend model via a company.

The Chancellor also announced changes to Capital Allowances, as well as Inheritance Tax which will lead to savings for clients in the future.

Should you have any queries over how the budget affects you, please do not hesitate to contact our Scott Patrick or any member of the team on 0141 643 9200 and we will be happy to discuss and assist.

Comments (0)